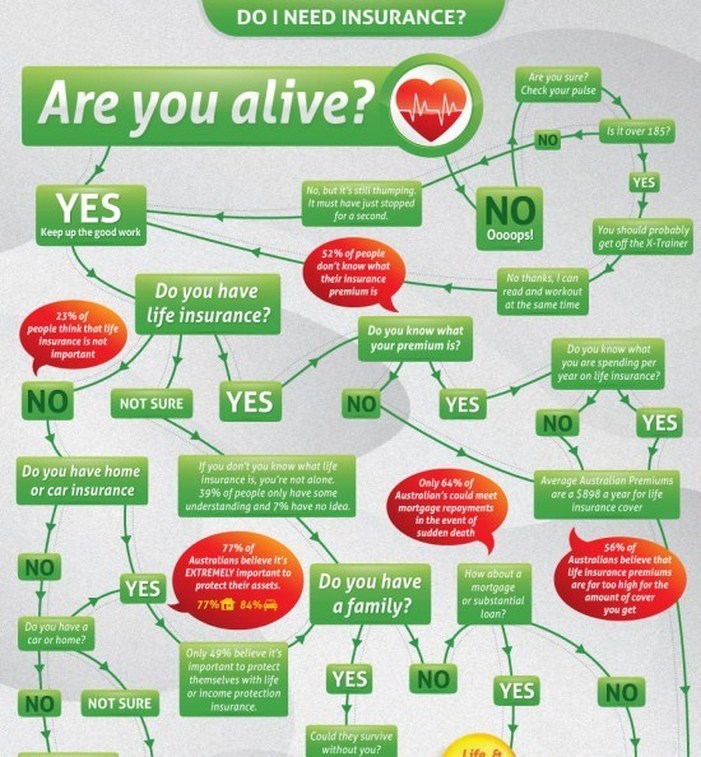

When I work with customers, I want to make sure I don’t lose them with terms and coverage descriptions that are often intimidating (not to mention boring).

Using the four R’s, I try to simplify insurance to them as:

Required, Risk management, Retention, and (most important) Rest easy.

Let’s take a look at what’s “Required”.

Most of us drive a vehicle and each state has laws that prescribe how liability is handled. In Oklahoma, individual drivers must have minimum limits of $25,000 for injury liability for one person; $50,000 for all injuries; $25,000 for property damage in an accident.

Commercial auto liability is often covered as a $1 million CSL (combined single limit).

And, additionally, if you own a home, you are generally required by your lender to have property coverage.

Finally, bonds are required for many contractors in order to maintain licensing with the state.

As you can see, requirements come from different sources.

Certainly there is much more to knowing what other additional requirements you may have to cover your business or personal assets, and that’s where a good agent can deliver more clarification.

I find this is usually a good place to start so people know why they need insurance in the first place.

Do you know if your insurance meets “requirements”??

Call me today and let’s start the discussion!

~Michael at 918.293.7115

Using the four R’s, I try to simplify insurance to them as:

Required, Risk management, Retention, and (most important) Rest easy.

Let’s take a look at what’s “Required”.

Most of us drive a vehicle and each state has laws that prescribe how liability is handled. In Oklahoma, individual drivers must have minimum limits of $25,000 for injury liability for one person; $50,000 for all injuries; $25,000 for property damage in an accident.

Commercial auto liability is often covered as a $1 million CSL (combined single limit).

And, additionally, if you own a home, you are generally required by your lender to have property coverage.

Finally, bonds are required for many contractors in order to maintain licensing with the state.

As you can see, requirements come from different sources.

Certainly there is much more to knowing what other additional requirements you may have to cover your business or personal assets, and that’s where a good agent can deliver more clarification.

I find this is usually a good place to start so people know why they need insurance in the first place.

Do you know if your insurance meets “requirements”??

Call me today and let’s start the discussion!

~Michael at 918.293.7115

RSS Feed

RSS Feed